How To Value a Business You Are Selling - or Buying.

There is more to business value than just an industry multiple of earnings.

The valuation of a small business is similar with subtle differences to large private companies. While a simple industry average multiple of SDE or EBITDA can get you an estimate, deeper, more analytical valuation insights can discover value not otherwise known.

There are three approaches to business valuation: The Income Approach, Market Approach, and Asset Approach.

By the end of reading this, you will be able to:

-

- Understand cash flow types used in small business sales and how to derive its value.

-

- Understand the three valuation approaches and some methods used in small business valuations.

-

- Understand the pros and cons of each valuation method.

I often hear people say my business is worth 3X EBITDA or 2.5X SDE. Their only knowledge of business value is in multiple of earnings but they do not realize that the:

“multiples are actually from calculations derived from fundamental data.”

3 Step Process To Business Valuation

Step 1 – Normalize income.

Step 2 – Calculate Enterprise Value one or multiple methods.

Step 3 – Average the value given by multiple methods for a defensible valuation.

Step 1 – Normalize Income

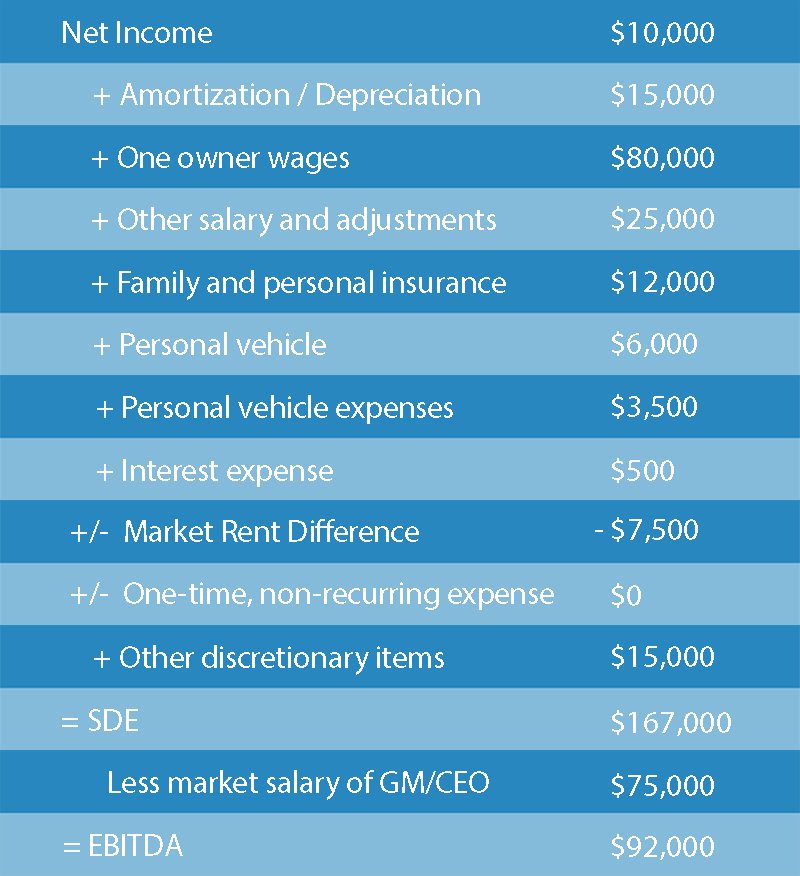

Normalization of Income to get Seller’s Discretionary Earnings

Prior to using the valuation models, you need to strip sales and expense values that are discretionary in nature. We want to determine the true economic benefit of a business excluding expenses (or sales) that are not part of the normal operation of the business.

The two most commonly used cash flow types for small business are SDE and EBITDA.

SDE – for Seller’s Discretionary Earnings

EBITDA – Earnings Before Interest Taxes Depreciation Amortization

These are the concise steps and formulas to normalize income:

SDE = Pre-tax Income + One owner salary (if paid) + Discretionary Expenses + Non-cash expenses + One time expenses + paid family members if any + market salary for family member

In order to determine EBITDA, you deduct a market salary for a General Manager or CEO from the SDE value.

Example Of Income Normalization

Uncover the full potential value of your business

Prefer to play it safe and have a market expert value your business? We have over 10 different methods to find an accurate and defensible business fair market value.

Step 2 – Calculate Enterprise Value

A. Income Approach

1. Discounted Cash Flow (DCF) Valuation Method

If you wanted a method on how to value a small business that produces a multiple instead of just making adjustments to a multiple, it would be the DCF valuation method. Using DCF requires good finance knowledge as it can get complex.

The discounted cash flow valuation model is an Income Approach that is frequently used in finance to determine the value of a business as a going concern. This method can be used for small right up to large Public Listed companies.

The essence of this model is “to determine today’s value of all projected future cash flow of a company adjusted for risk”.

Just imagine the reverse of earning interest from a bank. The bank pays you interest for your deposits over time. In DCF, you are trying to find what all that future interest is worth today.

The cash flow we use for small business valuations is different than for a large corporation like Apple. It is a simplified model without taking into account cash flow to firm or cash flow to equity. It will also not include CAPEX (capital expenditure).

When calculating the DCF for a business, the cash flow we use is either the SDE (Seller’s Discretionary Earnings), or EBITDA (Earnings Before Interest Taxes Depreciation and Amortization).

In a general rule of thumb, SDE is used for businesses where it is owner operated and earning below $500,000 a year. EBITDA is used for businesses earnings over $500,000 where there is management in place and the owner is minimally involved or absent.

In order to understand this valuation method, you need to know these few terms: Present Value (PV), Time Value of Money, Discount Rate, Terminal/Residual Value, Seller Discretionary Earnings (SDE), EBITDA.

Pro Tips:

-

- Projecting the income for the first 5 years is important. With DCF, you are able to fine tune projected earnings to the dollar.

-

- Do not mix up discount rates: Weighted Average Cost of Capital and Cost of Equity if you are building up a discount rate.

-

- If you are not building a discount rate, start from 35% for SDE and 25% for EBITDA.

-

- Match nominal or real Cash Flow to nominal or real Discount Rates. Real rates are inflation adjusted.

-

- Note that since central banks have deployed quantitative easing, the risk-free rates have been distorted compared to historical risk profiles. To be conservative, use historical average risk-free rates.

Steps to using Discounted Cash Flow:

-

- Determine the Cash Flow (SDE or EBITDA) for each of the previous 3 years.

-

- Give a weight to each year totaling 100%.

-

- Determine the right Discount Rate for the company (Rule of Thumb 30-35% for SDE and 20-25% for EBITDA. Or use CAPM-Capital Asset Pricing Model to derive from scratch)

-

- Using this weighted average SDE/EBITDA, project earnings over the next 5 years.

-

- Use the Discount Rate to find the Present Value of the projected Cash Flows for the next 5 years.

-

- Add up all the PV to give you Net Present Value (NPV)

-

- Find the capitalization rate and steady growth rate to calculate the Terminal Value.

-

- Add the Terminal Value and the NPV of Cash flow Year 1 – 5.

-

- The total becomes your Enterprise Value using the DCF method.

2. Capitalization of Earnings Valuation Method

The Capitalization of Earnings method is a basic and simplified version of in the Income Approach method.

The first step is to determine the capitalization (cap) rate which is simply the discount rate minus the growth rate. Once the capitalization rate is determined, you divide the earnings by the cap rate to give an estimate of enterprise value.

This Income Approach model assumes that the future growth rate remains steady into perpetuity. It may be used with relatively accurate results on mature businesses with steadily growing earnings.

Pro Tips:

-

- To determine the capitalization rate, use publicly traded stocks and adapt it for small business or get a rate from small business sales data.

-

- You may also use CAPM to determine the cap rate.

-

- Ensure to make price discount adjustments to account for lack of marketability of privately held companies.

-

- Global or national growth rates typically range between 1-5%. Global growth rate typically will range in the 1-3% range or inflation rate.

-

- Deciding what earnings figure to use appropriately. Use weighted average earnings. Businesses do not sell if valuations were based on a single year of earnings only.

Steps to using Capitalization of Earnings:

-

- Determine the discount rate with CAPM, rule of thumb, or market data.

-

- Find out the growth rate for your industry by region, countrywide, or global. The more localized, the better.

-

- Calculate the capitalization rate (discount rate – growth rate = capitalization rate)

-

- Know which earnings to use (EBITDA or SDE).

-

- Determine the value of the earnings figure to use. Best approach is weighted average of min 3 years earnings.

-

- Adjust price for lack of marketability if the discount rate was derived from publicly listed corporations.

-

- Determine the Enterprise Value.

3. Discretionary Earnings Multiple Valuation Method

The Discretionary Earnings Multiple method involves creating a table of factors affecting value, then assigning each factor with a multiple and the weightage in order to get weighted average multiple.

This is the method that many business brokers or business owners with little finance knowledge would use because of its simplicity.

The only issue with this valuation method is that it is subjective and may not be uniform among all users. The multiple, weights, and even the factor itself is subjective (the valuator decides on the starting multiples) but can be defended by the appraiser. Using this method may result in values that differ from appraiser to appraiser.

Once a weighted average multiple is determined, it is multiplied by the SDE or EBITDA of the company to get an Enterprise Value.

Pro Tips:

-

- Subjective in nature but can be defended if you provide past transaction evidence.

-

- Defending the magnitude of adjustments is, however, more difficult.

-

- May not have uniform or closely matched valuations across different appraisers.

-

- High potential to skew results to favor the appraiser’s intent.

-

- Simple and straight forward.

-

- Used by many brokers for its simplicity.

Steps to using Discretionary Earnings Multiple:

-

- Identify factors that affect value and assign minimum of 3 levels and match each level to a multiple.

-

- Give appropriate weight to each factor according to level of impact on business value.

-

- Multiply the selected factor multiple by the assigned weight and add them all up.

-

- Multiply the weighted average multiple by the (weighted) average discretionary earnings.

-

- Final value is the estimated enterprise value

B. Market Approach

1. SME Transaction Comparable Valuation Method

The first Market Approach to business valuation is by using SME transaction comparable data. This obtainable data is through voluntary submission by business brokers into several databases. This data is then resold through several database vendors for a fee typically in the hundreds of dollars.

Using past transaction data of SME business sales, we can have a strong feel for the value of a current comparable business. The market data used in this method shows what the market is willing to pay for a similar business. Therefore, the information obtained from this approach is not theoretical, but direct from the market.

The market is made up of thousands of buyers and sellers. To understand the market, we need to know what buyers’ objectives are. The two factors affecting their decision are what the earnings are, and what they are willing to pay for the earnings.

Pro Tips:

-

- Important to identify a close comparable to the business you are valuing.

-

- Adjust the multiple to account for differences in the comparable. i.e. better profit/gross margin, better return on capital, etc.

-

- Use as recent data as possible. Not over 5 years, maximum 7.

-

- Understand the data provided. Take note of market conditions that might distort price data i.e. 2008 great recession.

Steps to using SME Transaction Comparable:

-

- Get transaction data for comparable businesses with data purchased from good sources.

-

- Review the data, study the dates and adjust for market conditions and outliers.

-

- Compile values.

-

- Adjust target company multiples of your business to comparable data to account for revenue size, efficiencies, profitability. i.e. if your business has a higher gross margin than the comparable, increase your multiple by a factor. If your inventory turnover is lower than comparable, decrease your multiple by a factor.

-

- Average the earnings multiple (SDE or EBITDA) of given data.

-

- The average multiple multiplied by your business SDE or EBITDA will give you an estimate of the enterprise value of your business.

2. Public Company Comparable Valuation Method

The second method in the Market Approach for business valuation is the Public Company Comparable method. Due to SEC or Provincial Securities Commissions in Canada requiring audited financial statements and disclosure of public companies, data on such companies are freely available to anyone. This allows anyone to use these data to compare other similar companies.

Generally, the Public Company Comparable method may be used to evaluate a business valued over $50 million using 3 or more similar public companies but can be used for smaller businesses after very sophisticated tweaks and adjustments.

Pro Tips:

-

- Not to be used to compare if the difference between the public company and business being evaluated is large and requires a 50% or more adjustment.

-

- Not to be used if private company has unusual issues. i.e. major lawsuits, fraud, high customer concentration.

-

- Note any unusual share price performance of the public company due to acquisitions (takeover announcement) or financial engineering (share buyback announcements).

Steps to using Public Company Comparable

-

- Find the SIC Code and/or ask the business owner who they compete with that are public(listed) companies.

-

- Identify 3 or more similar companies.

-

- Extract the current financials for the public company and the current stock price and performance. PE ratio. Discard low liquidity companies (low traded volume or penny stocks/pink sheets).

-

- Discard companies with unusual activity. i.e. acquisition target announcements (inflated stock price), share buyback announcements, etc.

-

- Calculate the private company financial ratios and compare with the public company ratios. Make adjustments accordingly.

-

- Make adjustments to private company for lack of marketability, better key financial ratios, etc.

-

- Use the average multiple (or PE ratio) to calculate the value of the private enterprise adjusted for lack of marketability.

3. Merger & Acquisition Comparable Valuation Method

The last but equally important Market Approach method is the M&A Comparable method. The M&A Comparable method and the Public Company Comparison method are similar within the Market Approach but with subtle differences. Instead of taking data from the stock market, it is taken from M&A deals where the information is better available than for SME transactions.

Pro Tips:

-

- In M&A deals, whole (or majority stake) companies are transacted at once and provide a lot of information. It is different for publicly listed companies on the stock exchange where the valuation is very current because of very high liquidity but only a portion of the company is for sale at any one time.

-

- M&A deals may already reflect the lack of marketability adjustment into their deals. Get a deeper understanding of the transaction if data is available.

Steps to using Merger & Acquisition Comparable

-

- Search for a few historical M&A transactions for similar companies.

-

- Compile data, analyze, compare, and adjust to subject (company you are valuing) for size, financial ratios, lack of marketability (if any).

-

- Use the average multiples of comparable to determine subject company value.

C. Asset Approach

1. Capitalized Excess Earnings Valuation Method

The first method to the Asset Approach is the Capitalized Excess Earnings method. You calculate the value of the business by first finding the fair market value (FMV) of the net tangible assets, then by finding the value of the goodwill (excess earnings). The total of these two combined gives the value of the enterprise.

Pro Tips:

-

- Note the circular reasoning that could be problematic when finding capitalization rates. You need to know the weighted average cost of capital to use this method. However, since you will already know the WACC, you could use other methods more accurately.

-

- Note the blanket disproportion level of earnings in any asset class or group.

-

- Useful when the fair market value of assets comprises the most if not all the value of the company (and business has little or no income).

-

- Better methods are available if business has higher income.

Steps to Capitalized Excess Earnings

-

- Determine the FMV of tangible assets.

-

- Determine the business earnings.

-

- Calculate the weighted average cost of capital (WACC) with either CAPM

2. Asset Accumulation Valuation Method

The second Asset Approach is the Asset Accumulation method. This is most useful when the value of the assets is greater than the capitalized value of the company. Meaning the value of the parts is greater than the whole.

This valuation method is used for companies when earnings are inadequate to give a value greater than the FMV of assets.

Pro Tips:

-

- Do not use if there are sufficient earnings where market or income approach would be more reflective of market value.

-

- Uses the replacement cost / substitution theory which is theoretical and not always what people are willing to pay.

-

- Include off balance sheet asset items such as: intellectual property, key distribution and customer contracts, strategic partnership agreements, etc.

-

- Include off balance sheet liabilities: pending legal judgements, tax obligations, environmental compliance, etc.

Steps to using Asset Accumulation

-

- Determine tangible asset FMV.

-

- Determine intangible asset FMV including off balance sheet assets.

-

- Determine off balance sheet liabilities.

-

- Add all the assets minus the liabilities.

-

- Final amount is the value of the business.

Step 3 – Average The Final Values

A typical valuation with a higher degree of confidence will not use a single method to determine the value of a business.

In order to get a defensible business value, there must have been at least 2 to 4 methods used and each will have a different calculated value.

Once you have the values from all the methods that you have used, find the average by adding up all the enterprise values and dividing by the number of methods.

When you have the average enterprise value and you want to determine the multiple that this valuation exercise has produced, divide the average enterprise value by the average SDE or EBITDA.

Frequently Asked Questions About Business Valuations

Will I be able to value my business on my own accurately?

You could get an industry average multiple and use it to estimate the value of your business, but it may not be accurate and may miss certain things that could overvalue or undervalue your business by up to 1X multiple or more. That’s at least an entire year of income in value lost.

What is normalization of income statement?

The simplest explanation of normalization is to determine the total amount of earnings available to any buyer regardless of:

-

- Personal tax optimization strategies (personal expenses, insurance, auto, etc)

-

- Depreciation/amortization. These are non-cash expenses, meaning they appear as expenses but you probably did not actually pay for them that year.

-

- How much an owner decides to pay themselves.

-

- Other discretionary items.

Is there a simpler way to value a small business?

Many people with non-finance background often talk about multiples. This is easy to understand as you take earnings and simply multiply it to get a business value. Different industries will have different multiples and businesses with higher SDE/EBITDA typically get a higher multiple.

You may estimate that you could sell for 2-3 times earnings but in order to know if your business could get 2.7x earnings will require a more in depth look at every financial and business aspect of the company.

Enterprise Value is so much more than just slapping on a multiple and even coming short of $5,000 in value will make a professional valuation pay for itself.

How comprehensive must my business valuation need to be?

While finding a business value to within 5-10% of market potential (something where the business will sell), going overboard in valuation with techniques that are so sophisticated and ultra-detailed is also not the best use of resources.

These certified valuations usually cost a minimum of $10,000-15,000 and will give you 50 pages of very detailed work. These are usually used in divorce or partnership dispute courts, inheritance tax calculations, etc where they need a definitive number.

We provide an expert Opinion of Value with bonus business value optimization recommendations that you can make to get even more money out of the sale of your business.

Let Us Do The Heavy Lifting

Sure you could slap a 2X or 3X on your SDE or EBITDA and put your business for sale. However, a proper and defensible value of your business to buyers and their lenders require a much more in-depth analysis using widely accepted best valuation practices. Is it 1.5X SDE plus Inventory? Or 3.5X EBITDA including working capital? Each business type have different convention.

We know fair market valuations and market transactions. Make the best choice today and get a professional report.